How I Find Country Pairs for Mean Reversion Strategy

As mentioned in my previous post here, the first step for a mean reversion strategy is to conduct some background quantitative research.

Step 1

First, I use a pair trading function to loop across 800+ country pairs (created from combination function),

pair_trading = function(stock1, stock2, trade_amount, finance_rates, start_date, end_date,

prop_train, enter_z_score, exit_z_score){

## More codes here

## Return this

key_info = list(

ticker = c(stock1, stock2),

start_date = start_date,

trade_table = data_trade,

sharpe = c(sharpeRatioTrainset, sharpeRatioTestset),

half_life = half_life,

profits = data_trade_stats,

max_drawdown = c(table.DownsideRisk(data$pnl[trainset])[1]$pnl[7], table.DownsideRisk(data$pnl[testset])[1]$pnl[7]),

returns = cbind(table.AnnualizedReturns(data$pnl[trainset]), table.AnnualizedReturns(data$pnl[testset])),

hedgeRatio_mean_sd = c(as.numeric(hedgeRatio), as.numeric(data_trade$spreadMean[nrow(data_trade)]), as.numeric(data_trade$spreadStd[nrow(data_trade)])), #critical -->to be used in real-time trading

close_z_score = as.numeric(data_trade$zscore[nrow(data_trade)]),

hist_spread = data_trade$spread[(nrow(data_trade) - round(half_life) + 2):nrow(data_trade)],

prop_days_mkt = c(prop_days_mkt_train, prop_days_mkt_test),

close_price = c(data_trade$Close[nrow(data_trade)], data_trade$Close.1[nrow(data_trade)]),

win_rate = c(perc_win_train, perc_win_test)

# ,

# chart_train = charts.PerformanceSummary(data$pnl[trainset]),

# chart_test = charts.PerformanceSummary(data$pnl[testset])

)

return(key_info)

}

Step 2

- Next, I select pairs with sharpe ratio >1 in both training and testing periods.

- And also select pairs with shorter half-life i.e. shorter duration before it reverts to its mean path - more than 5 and lesser than 25

Step 3

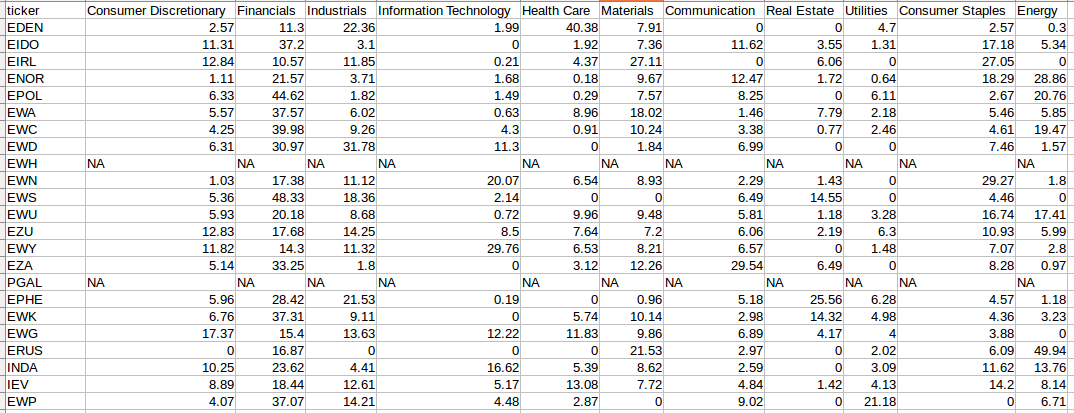

Then I went on to IShares website to get the respective tickers’ industries’ composition.

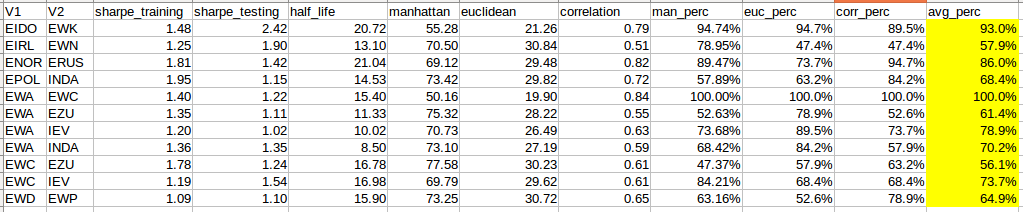

With this new piece of information, I went on to compute the manhattan distance, euclidean distance and correlation between these country pairs.

Next I applied percentile ranks to these distance measures and find an average percentile rank

Anything that is above 50th percentile is selected.

distance_metrics = function(stock1, stock2){

dist = c(NA, NA, NA)

tryCatch({

ctry_pair_composition_sub = subset(ctry_pair_composition, ctry_pair_composition$ticker == stock1 | ctry_pair_composition$ticker == stock2)

manhattan = as.numeric(distance(ctry_pair_composition_sub[, -1], method = "manhattan"))

euclidean = as.numeric(distance(ctry_pair_composition_sub[, -1], method = "euclidean"))

correlation = cor(as.numeric(ctry_pair_composition_sub[1, -1]), as.numeric(ctry_pair_composition_sub[2, -1]))

dist = c(manhattan, euclidean, correlation)

}, error=function(e){})

return(dist)

}

And ta-dah! This is the final selected country pairs that I will be using for my mean reversion strategy.

Further improvement

Note: I could have applied co-integration test. Will do it pretty soon.