In these 2 weeks, I’ll deploy my pair trading algo strategy into my server.

I modified the code below from a renowned quant trader, Ernest Chan. The basic idea is to find z-scores through moving average & moving SD of spread. If it’s more than absolute of z-score, I will either short or long the spread depending on the polarity.

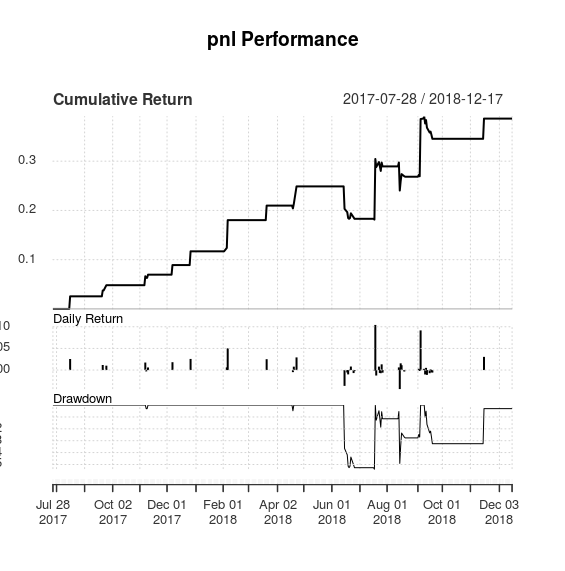

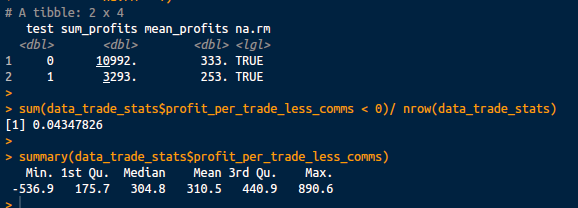

In the backtesting below (using a pair of silver ETFs as an example), I assumed a hypothetical amount of 10,000 dollars per trade.

Results are pretty good with a healthy sharpe ratio of 2.7 in the training set and 1.6 in the testing set of data. Annualized return is approximately 26% (translates to 2600 dollars) for the test set.

rm(list=ls()) # clear workspace

library('zoo')

library("tidyr")

library("dplyr")

require("quantmod")

require("urca")

require("PerformanceAnalytics")

source('R/util/calculateReturns.R')

source('R/util/calculateMaxDD.R')

source('R/util/backshift.R')

source('R/util/extract_stock_prices.R')

#List of silver etfs, SIVR, USV, SLV, DBS

stock1 = "SIVR"

stock2 = "USV"

start_date = "2014-12-30"

end_date = "2018-12-30"

prop_train = 0.65

enter_z_score = 2 #Can use nlmb to vary

exit_z_score = 1 #Can use nlmb to vary

trade_amount = 10000

finance_rates = 2.5/100

data1 = df_crawl_time_series(stock1, start_date, end_date)

data1 = subset(data1, select = c("Date", "Open", "Close"))

data1$Date = as.Date(data1$Date)

data2 = df_crawl_time_series(stock2, start_date, end_date)

data2 = subset(data2, select = c("Date", "Open", "Close"))

data2$Date = as.Date(data2$Date)

data1 = xts(data1[, -1], order.by = data1[, 1])

data2 = xts(data2[, -1], order.by = data2[, 1])

data = merge(data1, data2)

data = as.data.frame(data)

data = subset(data, !is.na(data$Close) & !is.na(data$Close.1))

# define indices for training and test sets

trainset <- 1:as.integer(nrow(data) * prop_train)

testset <- (length(trainset)+1):nrow(data)

#Cointegration test-->See if test of r<=1 > threshold. If more cointegrating

jotest=ca.jo(data.frame(data$Close[trainset], data$Close.1[trainset]), type="trace", K=2, ecdet="none", spec="longrun")

summary(jotest)

is_coint = jotest@teststat[1] > jotest@cval[1,3]

if(is_coint){

print("This pair's training set is cointegrating")

}else{

print("This pair's training set is not cointegrating")

}

#Hedge ratio

result <- lm(data$Close[trainset] ~ 0 + data$Close.1[trainset])

hedgeRatio <- coef(result) # 1.631

#Spread

data$spread <- data$Close - hedgeRatio * data$Close.1

##########################Calculate half life#############################

# Calculate half life of mean reversion (residuals)

# Calculate yt-1 and (yt-1-yt)

# pull residuals to a vector

spread_train = data$spread[trainset]

y.lag <- c(spread_train[2:length(spread_train)], 0) # Set vector to lag -1 day

y.lag <- y.lag[1:length(y.lag)-1] # As shifted vector by -1, remove anomalous element at end of vector

spread_train <- spread_train[1:length(spread_train)-1] # Make vector same length as vector y.lag

y.diff <- spread_train - y.lag # Subtract todays close from yesterdays close

y.diff <- y.diff [1:length(y.diff)-1] # Make vector same length as vector y.lag

prev.y.mean <- y.lag - mean(y.lag, na.rm = T) # Subtract yesterdays close from the mean of lagged differences

prev.y.mean <- prev.y.mean [1:length(prev.y.mean )-1] # Make vector same length as vector y.lag

final.df <- data.frame(y.diff,prev.y.mean) # Create final data frame

# Linear Regression With Intercept

result <- lm(y.diff ~ prev.y.mean, data = final.df)

half_life <- -log(2)/coef(result)[2] #Looking at this to

if(half_life < 3){

half_life = 14

}

######################MA of Spread#################################

#Change this to half life for lookback-->https://flare9xblog.com/2017/11/02/pairs-trading-testing-for-conintergration-adf-johansen-test-half-life-of-mean-reversion/

#Try EMA too

data$spread = zoo::na.locf(data$spread)

data$spreadMean <- SMA(data$spread, round(half_life))

data$spreadStd <- runSD(data$spread, n = round(half_life), sample = TRUE, cumulative = FALSE)

# data$spreadMean <- mean(data$spread[trainset], na.rm = T)

# data$spreadStd <- sd(data$spread[trainset], na.rm = T)

data$zscore = (data$spread - data$spreadMean)/data$spreadStd

data$longs <- data$zscore <= -enter_z_score # buy spread when its value drops below 2 standard deviations.

data$shorts <- data$zscore >= enter_z_score # short spread when its value rises above 2 standard deviations.

# exit any spread position when its value is within 1 standard deviation of its mean.

data$longExits <- data$zscore >= -exit_z_score

data$shortExits <- data$zscore <= exit_z_score

#Signal

data$posL1 = NA

data$posL2 = NA

data$posS1 = NA

data$posS2 = NA

# initialize to 0

data$posL1[1] <- 0; data$posL2[1] <- 0

data$posS1[1] <- 0; data$posS2[1] <- 0

data$posL1[data$longs] <- 1

data$posL2[data$longs] <- -1

data$posS1[data$shorts] <- -1

data$posS2[data$shorts] <- 1

data$posL1[data$longExits] <- 0

data$posL2[data$longExits] <- 0

data$posS1[data$shortExits] <- 0

data$posS2[data$shortExits] <- 0

#positions

data$posL1 <- zoo::na.locf(data$posL1); data$posL2 <- zoo::na.locf(data$posL2)

data$posS1 <- zoo::na.locf(data$posS1); data$posS2 <- zoo::na.locf(data$posS2)

data$position1 <- data$posL1 + data$posS1

# data$position1 = -data$position1 #Don't know why. It should be flipped!!!

data$position2 <- data$posL2 + data$posS2

# data$position2 = -data$position2 #Don't know why. It should be flipped!!!

#Returns

data$dailyret1 <- ROC(data$Close) # last row is [385,] -0.0122636689 -0.0140365802

data$dailyret2 <- ROC(data$Close.1) # last row is [385,] -0.0122636689 -0.0140365802

#Backshifting here. But signal is for following day returns!. So can still use latest Z-score

data$date = as.Date(row.names(data))

data = xts(data[,-which(names(data) == "date")], order.by = data[, which(names(data) == "date")])

data$pnl = lag(data$position1, 1) * data$dailyret1 + lag(data$position2, 1) * data$dailyret2

#Sharpe ratio

sharpeRatioTrainset <- sqrt(252)*mean(data$pnl[trainset], na.rm = TRUE)/sd(data$pnl[trainset], na.rm = TRUE)

sharpeRatioTrainset

sharpeRatioTestset <- sqrt(252)*mean(data$pnl[testset], na.rm = TRUE)/sd(data$pnl[testset], na.rm = TRUE)

sharpeRatioTestset

#Performance analytics

charts.PerformanceSummary(data$pnl[testset])

table.Drawdowns(data$pnl[testset])

table.DownsideRisk(data$pnl[testset])

table.AnnualizedReturns(data$pnl[testset])

#Number of days not in the market

sum(data$pnl == 0, na.rm = T)/length(data$pnl)

#Putting a trade indicator

data$trade_indicator = lag(ifelse(data$position2 != 0 & !is.na(data$position2), 1, 0))

#Putting a unique id

count = 0

data$trade_id = NA

for(i in 2:nrow(data)){

if(as.numeric(data$trade_indicator[i-1]) == 0 & as.numeric(data$trade_indicator[i]) != 0){

count = count + 1

data$trade_id[i] = count

}else if(as.numeric(data$trade_indicator[i-1]) != 0 & as.numeric(data$trade_indicator[i]) != 0){

data$trade_id[i] = count

}

}

#Simple trade statistics

data$test = 0; data$test[testset] = 1

data$pnl_add1 = data$pnl + 1

data_trade = as.data.frame(data)

data_trade_stats = data_trade %>%

group_by(trade_id, test) %>%

summarize(trade_duration = n(),

cum_pnl = prod(pnl_add1, na.rm = T))

data_trade_stats$cum_pnl = data_trade_stats$cum_pnl - 1

data_trade_stats$profit_per_trade = data_trade_stats$cum_pnl * trade_amount

#Financing charges -->Depends on length of days

data_trade_stats$finance_fees = trade_amount * finance_rates * (data_trade_stats$trade_duration/365)

#Commission fees

data_trade_stats$comm_fess = 4 #2 for 1 pair

#Net profit

data_trade_stats$profit_per_trade_less_comms = data_trade_stats$profit_per_trade - data_trade_stats$finance_fees - data_trade_stats$comm_fess

#Average loss

data_trade_stats = data_trade_stats[-which(is.na(data_trade_stats)), ]

data_trade_stats %>%

group_by(test) %>%

summarize(sum_profits = sum(profit_per_trade_less_comms),

mean_profits = mean(profit_per_trade_less_comms),

na.rm = T)

sum(data_trade_stats$profit_per_trade_less_comms < 0)/ nrow(data_trade_stats)

summary(data_trade_stats$profit_per_trade_less_comms)